What Is Financial Planning & Why It’s the Smartest Investment You’ll Ever Make

In a world of market shifts, rising costs, and economic uncertainty, one of the most powerful decisions you can make is to build a solid financial planning strategy—not just for today, but for the decades ahead.

At LI Wealth Management Inc., we don’t just crunch numbers—we craft strategic roadmaps that help individuals and business owners gain clarity, confidence, and control over their financial future. Whether you're planning for retirement, managing a growing business, or navigating tax laws, financial planning ties it all together.

In this blog, we’ll walk you through what financial planning truly means, why it’s essential, and how our team can help you align your money with your mission.

What Is Financial Planning?

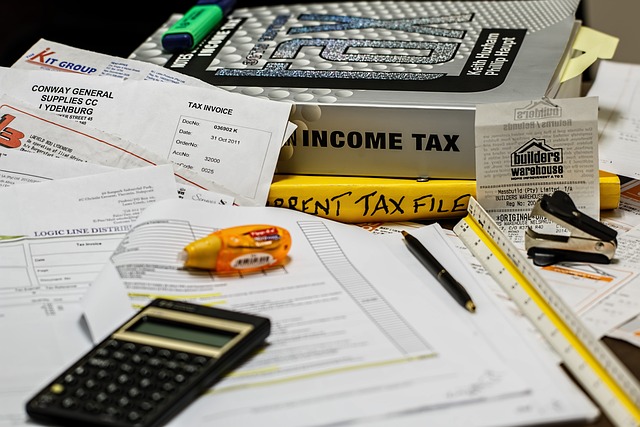

Financial planning is the process of evaluating your current financial situation, defining future goals, and creating a structured strategy to achieve them. It includes multiple components:

Tax Planning

Investment Management

Retirement Planning

Estate Planning

Insurance Review

Budgeting & Cash Flow

It’s not just for the wealthy. Everyone—at every income level—can benefit from having a financial plan.

The 6 Core Pillars of Financial Planning

At LI Wealth Management Inc., our approach is based on six interrelated pillars that work together to build long-term stability and success:

1. Tax Planning

Taxes can be one of the biggest costs you face over a lifetime. Strategic tax planning helps you reduce liabilities, structure your business for savings, and avoid surprises come filing season.

While strategy and accountability define great financial advisors, effective planning often includes smart tax approaches—see our blog on financial and tax planning for more.

✅ We design plans that take advantage of every legal deduction, deferral, and credit available. Check our Ultimate Guide to Tax Preparation.

2. Investment Planning

A strong investment plan matches your goals, risk tolerance, and timeline. It doesn’t chase trends—it builds wealth.

While investments grow your wealth, insurance coverage ensures those assets are protected. See how insurance planning complements your investment strategy.

✅ We construct diversified portfolios aligned with your values and goals, using proven strategies to navigate risk.

Learn more in Your Complete Guide to Tax, Estate, Insurance, Investment & Retirement Planning

3. Retirement Planning

A fulfilling retirement starts with knowing your number: how much you’ll need, and how to get there. Once you’re confident in the numbers, it’s time to explore the best social hobbies and social activities adults enjoy to make those retirement years truly meaningful. Discover ideas to stay active and connected.

✅ We help you evaluate IRAs, 401(k)s, Social Security, and more—so you can retire on your own terms.

Curious about how to test-drive your retirement lifestyle before fully leaving work? Learn more in our mini-retirement blog—a smart step in your retirement planning journey.

4. Estate Planning

It’s not just about assets—it’s about legacy. Proper estate planning ensures your wishes are carried out and your loved ones are protected. And when paired with life insurance, it becomes a powerful tool to protect your family's future—see how we discussed it on overlooked essentials of a solid financial plan.

Estate planning is just one part of a larger strategy—our guide on financial advisors retirement shows how to integrate legacy and retirement goals seamlessly.

✅ We partner with estate attorneys to guide you on wills, trusts, and healthcare directives.

🔗 Estate Planning Checklist – Investopedia

5. Insurance Planning

Insurance is often overlooked—but it’s vital. From life to disability, the right policies can protect you and your family from financial disaster.

✅ We help you assess current policies, eliminate gaps, and align coverage with your goals.

6. Budgeting & Cash Flow Management

If you don’t know where your money is going, it’s hard to plan for the future. Effective budgeting gives you the power to control spending and save strategically.

✅ We help clients build smart budgets that reflect their lifestyle and goals, without sacrificing joy.

For early-career professionals navigating student loans and new family expenses, setting realistic budgets is key—see how to align your budget with long-term goals in our post on Balancing Loans, Retirement Saving, and College Saving.

Why Financial Planning Matters More Than Ever

Let’s look at some reasons why now is the time to get serious about your financial future:

✔️ Inflation & Market Volatility

The cost of living is rising, and markets can swing fast. A well-designed financial plan protects you from uncertainty.

Market swings affect more than short-term returns—they also shape long-term legacy plans. See how Estate Planning Made Easy helps safeguard assets.

✔️ Life Transitions

Marriage, children, career changes, and retirement all impact your finances. A plan helps you prepare—not just react.

✔️ Wealth Building

Money left unmanaged rarely grows. Financial planning helps you turn income into assets, and assets into freedom.

Who Should Have a Financial Plan?

Many people mistakenly believe that financial planning is only for the wealthy. In reality, anyone can benefit, including:

Young professionals building financial habits

Families balancing savings with education costs

Business owners managing income and taxes

Retirees looking to preserve assets

Anyone planning a major life event (marriage, relocation, etc.)

“You don't have to be rich to plan—but planning is how many people get there.”

How LI Wealth Management Inc. Creates a Personalized Plan

We understand that no two financial lives are the same. That’s why our process is custom-tailored, not cookie-cutter.

Here’s what our process looks like:

1. Discovery

We start with a conversation to understand your current financial picture, concerns, and dreams.

2. Evaluation

We review your tax returns, investments, insurance, and budget to uncover gaps and opportunities.

3. Strategy Design

We develop a strategic roadmap across all 6 pillars of financial planning.

4. Implementation

We walk with you step by step, coordinating with attorneys, CPAs, and investment partners when needed.

5. Ongoing Support

Life changes—and so should your financial plan. We, as your financial advisors, review and refine strategies regularly to ensure they stay aligned.

Flat-Fee Financial Planning: Transparent, Honest, Effective

At LI Wealth Management Inc., we don’t believe in hidden fees or commissions. That’s why we offer flat-fee financial planning, so you know exactly what you’re paying for and can trust that our recommendations are truly in your best interest.

No pressure. No product pushing. Just smart advice you can trust.

What Our Clients Say

“LI Wealth Management helped us completely restructure our small business finances. We now have clarity, and we’re on track for retirement years earlier than expected.”

— Andrea & Luis M., Brooklyn, NY

“I thought financial planning was only for wealthy people—turns out it’s exactly what we needed to stop living paycheck to paycheck.”

— Rebecca T., Queens, NY

Ready to Take Control of Your Financial Future?

You’ve worked hard for your money—now let’s make your money work for you.

👉 Book a free, no-pressure consultation with our team and get your custom financial planning roadmap.

🔗 Schedule Now

Final Thoughts

Just like smart financial planning, personal progress also starts with clarity and small, intentional steps — a journey we explore further on becoming a better you, one step at a time.

A financial plan isn’t a luxury—it’s a necessity. In today’s world, where financial decisions are more complex than ever, having a trusted partner and a clear plan makes all the difference.

At LI Wealth Management Inc., our mission is to simplify that complexity and help you thrive—not just survive.